Types of Stock Market Charts

by PRINCE ·

1. Types of Stock Market Charts

There are three main types of stock market charts:

(A) Line Chart

- Simplest chart, showing only the closing price over time.

- Useful for identifying trends but lacks detailed price action.

(B) Bar Chart (OHLC – Open, High, Low, Close)

- Shows four price points for each period:

- Open: Where the stock started.

- High: The highest price.

- Low: The lowest price.

- Close: Where the stock ended.

- Helps analyze volatility and trend strength.

(C) Candlestick Chart (Most Popular)

- Each candle represents price movement for a specific period.

- Green (or White): Bullish (Closing price > Opening price).

- Red (or Black): Bearish (Closing price < Opening price).

- Key Patterns:

- Doji → Indecision (Reversal possible)

- Hammer → Bullish reversal

- Shooting Star → Bearish reversal

- Engulfing Candles → Strong trend confirmation

2. Key Chart Components

When analyzing stock charts, focus on these elements:

(A) Time Frames

- Intraday (1 min, 5 min, 15 min) → Best for day trading and scalping.

- Swing Trading (1 hour, 4 hours, daily) → Medium-term trades.

- Long-Term (weekly, monthly) → For investors.

Since you’re into options trading, shorter time frames (5 min, 15 min, 1 hour) will be most useful.

(B) Price Action & Trend Lines

- Uptrend: Higher highs and higher lows.

- Downtrend: Lower highs and lower lows.

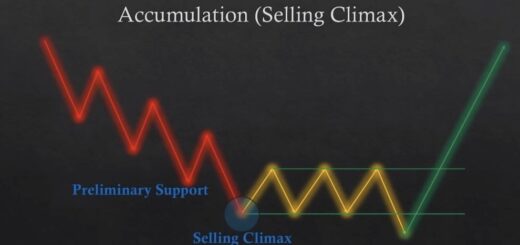

- Sideways (Consolidation): Price moves in a range.

Use support & resistance levels to predict where price may reverse or break out.

3. Technical Indicators to Use

(A) Moving Averages

- Simple Moving Average (SMA): Basic trend indicator.

- Exponential Moving Average (EMA): Faster reaction to price (better for trading).

- Golden Cross (Bullish Signal): 50 EMA crosses above 200 EMA.

- Death Cross (Bearish Signal): 50 EMA crosses below 200 EMA.

(B) Relative Strength Index (RSI)

- Measures momentum on a scale of 0 to 100.

- Above 70: Overbought (possible reversal).

- Below 30: Oversold (possible bounce).

- Between 40-60: Neutral zone.

(C) MACD (Moving Average Convergence Divergence)

- Shows momentum shifts.

- Bullish Crossover: MACD line crosses above the signal line.

- Bearish Crossover: MACD line crosses below the signal line.

(D) Bollinger Bands

- Helps measure volatility.

- Price touching upper band: Overbought.

- Price touching lower band: Oversold.

- Squeeze: Indicates a potential breakout.

(E) Volume

- High volume with price rise = Strong buying momentum.

- High volume with price drop = Strong selling pressure.

4. Chart Patterns for Trading Options

(A) Bullish Patterns

- Ascending Triangle → Breakout potential.

- Cup & Handle → Strong uptrend ahead.

- Double Bottom → Trend reversal (bullish).

(B) Bearish Patterns

- Head & Shoulders → Trend reversal (bearish).

- Descending Triangle → Breakdown expected.

- Double Top → Bearish reversal.

5. Options Trading & Chart Analysis

- Use support/resistance zones for setting entry & exit points.

- Identify trend strength using RSI & MACD before buying calls/puts.

- Look for breakouts or breakdowns before entering trades.

- Check volume confirmation to validate strong moves.