How Institutional Investors Influence the Stock Market

Technical Analysis Basics in Trading

Technical analysis is a method used to evaluate and predict the future price movements of securities by analyzing historical market data, primarily price and volume. Here are some fundamental concepts and tools used in technical analysis:

1. Price Charts

Price charts are the foundation of technical analysis. They visually represent the price movements of a security over time. The most common types of charts include:

- Line Charts: Show the closing prices over a specific period, providing a simplified view of the trend.

- Bar Charts: Display the open, high, low, and close prices for each trading period, offering more detail than line charts.

- Candlestick Charts: Present the same information as bar charts but use candlestick patterns to highlight price movements and trend reversals.

2. Trends

Trends indicate the general direction in which the price of a security is moving. There are three main types of trends:

- Uptrend: A series of higher highs and higher lows.

- Downtrend: A series of lower highs and lower lows.

- Sideways Trend: When the price moves within a horizontal range.

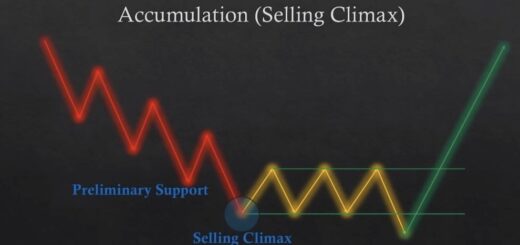

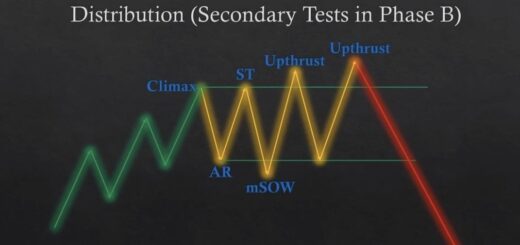

3. Support and Resistance

- Support: A price level where a downtrend can be expected to pause due to a concentration of buying interest.

- Resistance: A price level where an uptrend can be expected to pause due to a concentration of selling interest.

4. Indicators and Oscillators

Technical indicators and oscillators are mathematical calculations based on the price, volume, or open interest of a security. They help traders identify trends, momentum, volatility, and other aspects of price movements. Common indicators include:

- Moving Averages: Smooth out price data to identify the direction of the trend. Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Combines moving averages to identify changes in momentum and trend direction.

- Bollinger Bands: Consist of a middle band (SMA) and two outer bands that represent standard deviations above and below the SMA, indicating volatility.

5. Chart Patterns

Chart patterns are formations created by the price movements of a security on a chart. They help predict future price movements based on historical patterns. Common chart patterns include:

- Head and Shoulders: Indicates a reversal pattern.

- Triangles: Can indicate continuation or reversal, depending on the type (ascending, descending, or symmetrical).

- Double Tops and Bottoms: Indicate potential reversals.

6. Volume

Volume measures the number of shares or contracts traded in a security. It is an important aspect of technical analysis as it provides insight into the strength of a price movement. High volume during a price move suggests strong conviction, while low volume may indicate a lack of interest.

7. Trend Lines

Trend lines are straight lines drawn on a chart to connect significant price points, such as highs or lows. They help identify the direction and strength of a trend. An uptrend line is drawn below the price, connecting the lows, while a downtrend line is drawn above, connecting the highs.

8. Technical Analysis Assumptions

Technical analysis is based on three main assumptions:

- The market discounts everything: All information is already reflected in the price.

- Price moves in trends: Prices tend to move in trends rather than random movements.

- History tends to repeat itself: Price movements are repetitive due to market psychology.

Conclusion

Technical analysis provides traders with tools and techniques to analyze market behavior and make informed trading decisions. By studying price charts, trends, support and resistance levels, indicators, and patterns, traders can identify potential trading opportunities and manage risks effectively.