Different Types of Orders in Stock Market Trading

Different Types of Orders in Stock Market Trading

In stock market trading, various types of orders can be placed to buy or sell securities. Understanding these order types is crucial for executing trades effectively and managing investment strategies. Here are the primary types of orders:

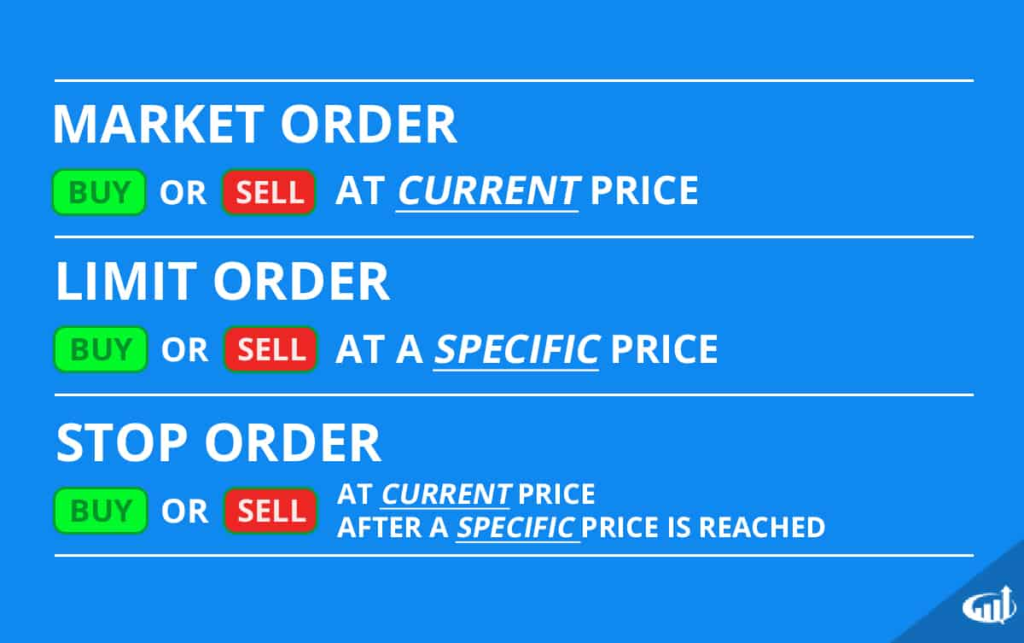

1. Market Order

A market order is an instruction to buy or sell a security immediately at the best available current price. This type of order guarantees that the order will be executed, but it does not guarantee the execution price. Market orders are typically used when the priority is to execute the trade quickly rather than at a specific price.

- Advantages: Immediate execution, suitable for highly liquid stocks.

- Disadvantages: Price uncertainty, especially in volatile markets.

2. Limit Order

A limit order is an order to buy or sell a security at a specific price or better. For a buy limit order, the trade will only be executed at the limit price or lower, and for a sell limit order, it will be executed at the limit price or higher.

- Advantages: Price control, useful in volatile markets.

- Disadvantages: No guarantee of execution if the market price does not reach the limit price.

3. Stop Order (Stop-Loss Order)

A stop order is an order to buy or sell a security once it reaches a specified price, known as the stop price. When the stop price is reached, the stop order becomes a market order.

- Advantages: Helps limit losses or protect profits.

- Disadvantages: Execution price may differ from the stop price in volatile markets.

4. Stop-Limit Order

A stop-limit order combines the features of a stop order and a limit order. It becomes a limit order when the stop price is reached, and it will only be executed at the limit price or better.

- Advantages: Provides price control after the stop price is triggered.

- Disadvantages: Risk of no execution if the limit price is not met.

5. All or None (AON)

An AON order specifies that the entire order must be executed or none of it. This is useful for large orders where partial fills are not acceptable.

- Advantages: Ensures full execution of the order.

- Disadvantages: May result in no execution if the full quantity is not available.

6. Immediate or Cancel (IOC)

An IOC order mandates that any portion of the order that can be executed immediately will be, and any remaining portion will be canceled.

- Advantages: Ensures immediate partial execution.

- Disadvantages: Remaining unexecuted portion is canceled.

7. Fill or Kill (FOK)

A FOK order is similar to an IOC order but requires the entire order to be executed immediately; otherwise, the entire order is canceled.

- Advantages: Ensures immediate and complete execution.

- Disadvantages: High risk of no execution.

8. Good ‘Til Canceled (GTC)

A GTC order remains active until it is executed or canceled by the trader. This type of order does not expire at the end of the trading day.

- Advantages: Long-term order validity.

- Disadvantages: Requires monitoring to avoid unintended executions.

9. Day Order

A day order is valid only for the trading day on which it is placed. If it is not executed by the end of the trading day, it is automatically canceled.

- Advantages: Limits exposure to overnight market risks.

- Disadvantages: Needs to be re-entered if not executed.

10. Market on Close (MOC)

An MOC order is executed at the closing price of the trading day.

- Advantages: Ensures execution at the end of the trading session.

- Disadvantages: Execution price is not known in advance.

11. Market on Open (MOO)

An MOO order is executed at the opening price of the trading day.

- Advantages: Ensures execution at the start of the trading session.

- Disadvantages: Execution price is not known in advance.

Understanding these different types of orders can help investors and traders execute their strategies more effectively, manage risks, and achieve their investment goals.