Difference Between Institutional Investors and Retail Investors

Difference Between Institutional Investors and Retail Investors

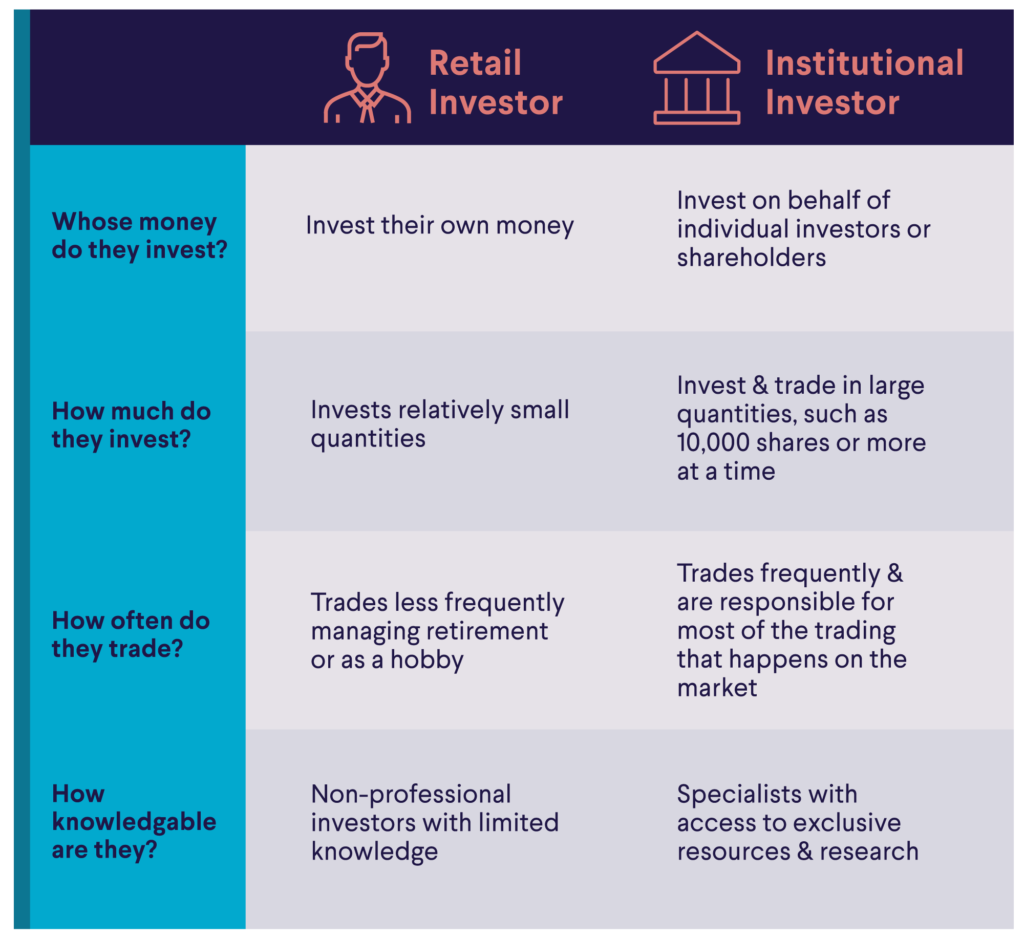

Institutional investors and retail investors are two primary types of participants in the financial markets, each with distinct characteristics, resources, and investment strategies. Understanding the differences between these two groups is crucial for comprehending market dynamics and making informed investment decisions.

Institutional Investors

Definition: Institutional investors are large organizations that invest substantial sums of money on behalf of their clients, members, or shareholders. Examples include mutual funds, pension funds, insurance companies, hedge funds, and endowments.Characteristics:

- Scale of Investment: Institutional investors trade in large volumes, often involving millions or billions of dollars.

- Resources: They have access to extensive research, advanced financial tools, and professional fund managers.

- Market Influence: Due to their large trade volumes, institutional investors can significantly influence market prices and trends.

- Investment Horizon: Typically, they focus on long-term financial objectives and risk management.

- Regulatory Environment: They are subject to fewer protective regulations compared to retail investors, as they are considered more sophisticated and knowledgeable.

- Transaction Costs: Institutional investors benefit from lower transaction costs due to economies of scale.

- Risk Management: They employ robust risk management frameworks and sophisticated strategies to diversify their portfolios.

Examples:

- Pension funds like CalPERS (California Public Employees’ Retirement System)

- Mutual funds managed by companies like Vanguard and Fidelity

- Hedge funds such as Bridgewater Associates and Renaissance Technologies

Retail Investors

Definition: Retail investors are individual investors who buy and sell securities for their personal accounts. They typically invest smaller amounts of money compared to institutional investors.Characteristics:

- Scale of Investment: Retail investors usually invest smaller amounts, often in the range of thousands or lakhs of rupees.

- Resources: They have limited access to advanced financial tools and research compared to institutional investors.

- Market Influence: Retail investors have minimal influence on market prices due to their smaller trade volumes.

- Investment Horizon: They often have shorter investment horizons and may focus on personal financial goals like saving for retirement or a child’s education.

- Regulatory Environment: Retail investors are subject to more protective regulations to safeguard their interests.

- Transaction Costs: They face higher transaction costs and fees compared to institutional investors.

- Risk Management: Retail investors are responsible for their own risk management and may find it challenging to achieve high levels of diversification.

Examples:

- Individual investors using brokerage accounts or retirement accounts like 401(k)s and IRAs

- Small business owners investing personal funds in the stock market

- High-net-worth individuals like Warren Buffett and Elon Musk

Key Differences

| Characteristic | Institutional Investors | Retail Investors |

|---|---|---|

| Type of Investor | Organizations managing large funds | Individual traders |

| Capital Base | Substantial | Smaller |

| Investment Horizon | Long-term | Short-term |

| Resources | Extensive | Limited |

| Professional Management | Employ professional fund managers | Typically self-directed |

| Risk Management | Robust risk management frameworks | Individual responsibility |

| Market Influence | Significant influence on market trends | Limited impact |

| Transaction Costs | Lower due to economies of scale | Higher |

| Regulatory Environment | Fewer protective regulations | More protective regulations |

| Access to Information | In-depth, timely, and exclusive information | Limited access to information |

| Emotional Trading | Less influenced by emotions, often use algorithmic trading | More susceptible to emotional decision-making |

Understanding these differences helps investors recognize their own strengths and limitations, enabling them to make better-informed investment decisions and develop strategies that align with their financial goals.