What is Wyckoff Trading?

Title: The Fundamentals of Wyckoff Trading Method: A Comprehensive Guide

During the early years of the 20th century, a stock trader named Richard Wyckoff proposed a universal trading methodology still used by traders today. Interestingly, the Wyckoff Method, an approach to trading securities, offers insights into the buying and selling decisions of professionals. Through a deep understanding of these insights, retail traders can significantly enhance their market predictions and trading outcomes. This article breaks down the Wyckoff trading methodology, supplemented with explanatory pictures and examples.

First, let’s get a brief background about the man behind the strategy.

The Wyckoff Method was designed by Richard Dempsey Wyckoff, one of the most influential and successful traders in the stock market. Wyckoff believed that markets behave cyclically, apparent through the patterns that continually reoccur in prices. He reasoned that by identifying these patterns and the phases of the market cycle, a trader could thrive in the marketplace.

Now, let’s unpack the core aspects of Wyckoff’s trading method.

1. The Law of Supply and Demand

Wyckoff’s first rule defines the force that drives prices. When demand outweighs supply, prices rise, and when supply is higher than demand, prices fall. Traders using Wyckoff’s method pay close attention to shifts in this dynamic since it often heralds a trend change.

2. The Law of Cause and Effect

Wyckoff believed that price movements don’t occur in a vacuum. Instead, they are the effect of a cause, which can be a piece of news, economic data, or trading activity. By analyzing these causes alongside their effects, traders can define potential movement magnitude.

3. The Law of Effort versus Result

The third law emphasizes that the volume should increase or decrease in line with the price. If the price is moving on low volume, it could indicate that a reversal may be imminent.

The Wyckoff Cycle

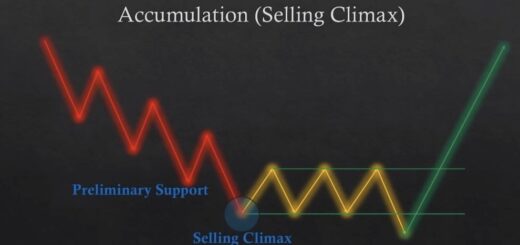

The Wyckoff Cycle is a crucial part of the Wyckoff Method. It depicts the lifecycle of a market trend and comprises four stages: Accumulation, Markup, Distribution, and Markdown.

1. Accumulation: This is the phase where professional traders begin to buy, establishing their long positions.

2. Markup: As demand increases, prices move upwards significantly followed by periods of consolidation.

3. Distribution: Professional operators lock in their profits by selling their positions.

4. Markdown: The price falls due to an increase in supply over demand.

Traders use charts to identify these phases and make trading decisions based on their analysis.

Example of Wyckoff Trading Method

For us to fully grasp the Wyckoff trading method, let’s examine an example with the price chart of a hypothetical Company A.

In March, the Accumulation stage takes place, characterized by a relatively flat movement as the price hovers around $10. Then as we move into April and May, we observe the Markup stage, and the price surges to peak at $17 in June. The Distribution phase begins in June and continues into July, with a decline in price. Finally, the Markdown occurs from August to September with a significant drop in prices to around $8.

To wrap up, Wyckoff’s trading method offers traders the tools to understand the market’s underlying logic, helping them predict the next market moves accurately. With practice analysis, implementation, and patience, you can harness the power of Wyckoff’s method and elevate your trading game.

As always, remember that while the Wyckoff method can be very effective, no strategy guarantees success. Every trading approach involves risk, and it’s crucial to manage your risk and learn as much as possible before starting.